Methodology

Royalton CRIX Crypto Index:

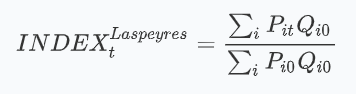

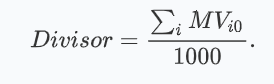

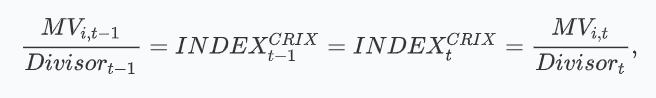

The Royalton CRIX Crypto Index is a market index and follows the Laspèyres construction. The index of Laspèyres is defined

as

Constituents:

It may happen, that a crypto has a high market capitalization, but is not traded frequently. One modified version of a liquidity rule from the STOXX Japan 600 and the AEX Family is employed. The applied rule is the following:

where ADTV0.25 is the 0.25 percentile of the ADTV distribution of all cryptos in the last period and ADTVi is the ADTV of a single crypto.

If a crypto fulfills the rule, it is eligible for the Royalton CRIX Crypto Index set of constituents.

Number of Constituents:

A fixed number of constituents may be a good approach for relatively stable markets. The amount of constituents in the Royalton CRIX Crypto Index is computed using a dynamic approach based upon the CRIX Technology Decision Criterion (CTDC).

(US Patent Pending; Docket Number: RPAG-100USP; U.S. Patent Application Serial No.: 63/183,373)

Weights:

Each crypto in Royalton CRIX Crypto Index is weighted with its market capitalization.

Reallocation:

Each quarter, the constituents are reevaluated.

Each month, the constituents are rebalanced.